National Income 12th Economics Lesson 2 Questions in English

12th Economics Lesson 2 Questions in English

2] National Income

1. Who introduced the concept of national income?

- Samuelson

- Simon Kuznets

- Alfred Marshall

- Adam Smith

Explanation

Nobel laureate Simon Kuznets first introduced the concept of national income. National Income provides a comprehensive measure of the economic activities of a nation.

2. Which of the following statement is correct?

- National Income denotes the country’s purchasing power

- National income serves as an instrument of economic planning

- Further, national income is one of the most significant macroeconomic variables

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

National Income denotes the country’s purchasing power. The growth of an economy is measured by the rate at which its real national income grows over time. National income thus serves as an instrument of economic planning. Further, national income is one of the most significant macroeconomic variables. Thus, a clear understanding of the meaning, concepts, measurement and uses of national income is essential.

3. What is the particular period of time for National Income?

- 3 months

- 6 months

- 9 months

- 1 year

Explanation

In common parlance, National Income means the total money value of all final goods and services produced in a country during a particular period of time (one year).

4. “The concept of national income is an indispensable preparation for tackling the great issues of

unemployment, inflation and growth” Who stated the above statement?

- Samuelson

- Simon Kuznets

- Alfred Marshall

- Adam Smith

Explanation

“The concept of national income is an indispensable preparation for tackling the great issues of unemployment, inflation and growth”. – Samuelson

5. Which of the following are some of the concepts used in measuring national income?

- GDP

- Disposable Income

- GDP deflator

- NNP at factor cost

- 1, 2, 3

- 1, 3, 4

- 2, 3, 4

- All the above

Explanation

The following are some of the concepts used in measuring national income:

- GDP

- GNP

- NNP

- NNP at factor cost

- Personal Income

- Disposable Income

- Per capita Income

- Real Income

- GDP deflator

6. ____is the total market value of final goods and services produced within the country during a year.

- GDP

- NNP

- GDP deflator

- GNP

Explanation

GDP is the total market value of final goods and services produced within the country during a year. This is calculated at market prices and is known as GDP at market prices.

7. What is the formula to calculated GDP by expenditure method at market prices?

- C + I + G

- C + I + G + (X – M)

- (C + I + G + (X-M) + (R-P))

- C + I

Explanation

GDP by expenditure method at market prices = C + I + G + (X – M) Where C – consumption goods; I – Investment goods; G – Government purchases; X – Exports; M – Imports (X – M) is net export which can be positive or negative

8. ______ is the value of net output of the economy during the year

- GNP

- NNP

- GDP

- NDP

Explanation

NDP is the value of net output of the economy during the year. Some of the country’s capital equipment wears out or becomes outdated each year during the production process. Thus, Net Domestic Product = GDP – Depreciation

9. What is the formula to calculate GNP?

- C + I + G

- C + I + G + (X – M)

- (C + I + G + (X-M) + (R-P))

- C + I

Explanation

GNP at market prices means the gross value of final goods and services produced annually in a country plus net factor income from abroad (C + I + G + (X-M) + (R-P))

10. Which of the following statement about GNP is correct?

- GNP is the total measure of the flow of final goods and services at market value resulting from current production in a country during a year excluding net income from abroad

- (R-P) is the Net factor incomes from abroad which refers to the difference between factor incomes received from abroad by normal residents of India and factor incomes paid to the foreign residents for factor services rendered by them in the domestic territory in India

- goods and services produced or purchased by the government which is denoted by (X-M)

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

GNP is the total measure of the flow of final goods and services at market value resulting from current production in a country during a year, including net income from abroad. GNP includes five types of final goods and services : (1) value of final consumer goods and services produced in a year to satisfy the immediate wants of the people which is referred to as consumption (C); (2) gross private domestic investment in capital goods consisting of fixed capital formation, residential construction and inventories of finished and unfinished goods which is called as gross investment (I) ; (3) goods and services produced or purchased by the government which is denoted by (G) ; and (4) net exports of goods and services, i.e., the difference between value of exports and imports of goods and services, known as (X-M) ; Net factor incomes from abroad which refers to the difference between factor incomes (wage, interest, profits ) received from abroad by normal residents of India and factor incomes paid to the foreign residents for factor services rendered by them in the domestic territory in India (R-P)

11. Which refers to the value of the net output of the economy during the year?

- NNP

- GDP

- NDP

- Personal income

Explanation

Net National Product refers to the value of the net output of the economy during the year. NNP is obtained by deducting the value of depreciation, or replacement allowance of the capital assets from the GNP. It is expressed as, NNP = GNP – depreciation allowance.

12. Which of the following statement is correct?

- NNP at factor cost = NNP at Market prices – direct taxes + Subsidies

- NNP refers to the market value of output.

- NNP at factor cost is the total of income payment made to factors of production

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

NNP refers to the market value of output. Whereas NNP at factor cost is the total of income payment made to factors of production. Thus, from the money value of NNP at market price, we deduct the amount of indirect taxes and add subsidies to arrive at the net national income at factor cost.

NNP at factor cost = NNP at Market prices – Indirect taxes + Subsidies.

13. Which of the following statement is correct?

- Personal income is the total income received by the individuals of a country from all sources after payment of direct taxes in a year.

- Personal income is never equal to the national income, because the former includes the transfer payments whereas they are not included in national income.

- Personal Income = National Income – (Social Security Contribution and undistributed corporate profits) + Transfer payments

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Personal income is the total income received by the individuals of a country from all sources before payment of direct taxes in a year. Personal income is never equal to the national income, because the former includes the transfer payments whereas they are not included in national income. Personal income is derived from national income by deducting undistributed corporate profit, and employees’ contributions to social security schemes and adding transfer payment.

Personal Income = National Income – (Social Security Contribution and undistributed corporate profits) + Transfer payments.

14. Assertion(A): Disposable Income is the amount available for households for consumption.

Reason(R): It is the income of individuals after the payment of income tax

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

Disposable Income is also known as Disposable personal income. It is the income of individuals after the payment of income tax. This is the amount available for households for consumption.

Disposable Income = Personal income – Direct Tax. As the entire disposable income is not spent on consumption, Disposal income = consumption + saving

15. What is the formula to calculate Per Capita Income?

- National Income/ Population

- Population/ National Income

- (GDP – Depreciation)/ Population

- Population/ (GDP – Depreciation)

Explanation

The average income of a person of a country in a particular year is called Per Capita Income. Per capita income is obtained by dividing national income by population.

Per Capita income = National Income/ Population

16. ______ is national income expressed in terms of a general price level of a particular year

- Personal income

- Nominal income

- Net national income

- All the above

Explanation

Nominal income is national income expressed in terms of a general price level of a particular year in other words, real income is the buying power of nominal income.

17. What is the way to calculate National Income at constant price?

- National Income at current price ÷ P0 / P1

- National Income at current price ÷ P1 / P0

- (National Income at current price/ National Income at Previous year price) X P1 / P0

- (National Income at Previous year price /National Income at current price) X P1 / P0

Explanation

National income is the final value of goods and services produced and expressed in terms of money at current prices. But it does not indicate the real state of the economy. The real income is derived as follows:

National Income at constant price = National Income at current price ÷ P1 / P0

P1 – Price index during current year; P0 – Price index during base year

18. What is the formula to calculate GDP deflator?

- (Nominal GDP/ Real GDP) x 100

- (Real GDP/ Nominal GDP) x 100

- (Nominal GDP- Real GDP) x 100

- (Real GDP- Nominal GDP) x 100

Explanation

GDP deflator is an index of price changes of goods and services included in GDP. It is a price index which is calculated by dividing the nominal GDP in a given year by the real GDP for the same year and multiplying it by 100.

GDP deflator = (Nominal GDP/ Real GDP) x 100

19. Which of the following statement is correct?

- All goods and services produced in the country must be counted and converted against money value during a year

- Thus, whatever is produced is either used for consumption or for saving.

- National output can be computed at any of three levels, viz., production, income and expenditure

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

All goods and services produced in the country must be counted and converted against money value during a year. Thus, whatever is produced is either used for consumption or for saving. Thus, national output can be computed at any of three levels, viz., production, income and expenditure.

20. Which of the following equation must hold good for all production, income and expenditure

method to be correct?

- Output = Income + Expenditure

- Output = Income = Expenditure

- Output = Income – Expenditure

- Output = Income x Expenditure

Explanation

there are three methods that are used to measure national income.

1. Production or value – added method

2. Income method or factor earning method

3. Expenditure method

And if these methods are done correctly, the following equation must hold

Output = Income = Expenditure

This is because the three methods are circular in nature. It begins as production, through recruitments of factors of production, generating income and going as incomes to factors of production

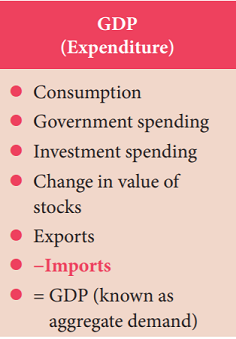

21. Which of the following should be negative in calculation of GDP expenditure method?

- Consumption

- Change in value of stocks

- Government spending

- Imports

Explanation

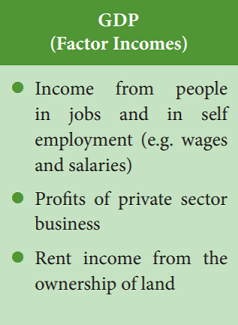

22. In which of the following method Rent income from the ownership of land is added?

- GDP (Expenditure)

- GDP (Factor Incomes)

- GDP (Value of Output)

- All the above

Explanation

23. Which of the following sectors are used in value added method?

- Primary

- Secondary

- Manufacturing

- Quaternary

- 1, 2, 3

- 1, 3, 4

- 2, 3, 4

- All the above

Explanation

24. Which of the following statement is correct?

- Product method measures the output of the country

- The value obtained is actually the GDP at market prices.

- It is also called inventory method.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Product method measures the output of the country. It is also called inventory method. Under this method, the gross value of output from different sectors like agriculture, industry, trade and commerce, etc., is obtained for the entire economy during a year. The value obtained is actually the GNP at market prices. Care must be taken to avoid double counting.

25. How many agricultural commodities in India are estimated by product method?

- 100

- 95

- 64

- 50

Explanation

In India, the gross value of the farm output is obtained as follows:

(i) Total production of 64 agriculture commodities is estimated. The output of each crop is measured by multiplying the area sown by the average yield per hectare. (ii) The total output of each commodity is valued at market prices. (iii) The aggregate value of total output of these 64 commodities is taken to measure the gross value of agricultural output. (iv) The net value of the agricultural output is measured by making deductions for the cost of seed, manures and fertilisers, market charges, repairs and depreciation from the gross value.

26. Which of the following statement is correct?

- The gross values of the output of animal husbandry, forestry, fishery, mining and factory establishments are obtained by multiplying their estimates of total production with market prices.

- Net value of the output in these sectors is derived by making deductions for cost of materials used in the process of production and depreciation allowances, etc. from gross value of output

- 1 alone

- 2 alone

- 1, 2

- None

Explanation

The gross values of the output of animal husbandry, forestry, fishery, mining and factory establishments are obtained by multiplying their estimates of total production with market prices. Net value of the output in these sectors is derived by making deductions for cost of materials used in the process of production and depreciation allowances, etc. from gross value of output. Net value of each sector measured in this way indicates the net contribution of the sector to the national income.

27. Product method of national income calculation is suitable for__________ countries

- Developed

- Developing

- Underdeveloped

- All the above

Explanation

The product method is followed in the underdeveloped countries, but it is less reliable because the margin of error in this method is large. In India, this method is applied to agriculture, mining and manufacturing, including handicrafts.

28. What should be done as a precaution in Product method of national income calculation?

- Double counting should be avoided

- Value of output used for self-consumption should be counted

- sale and purchase of second hand goods should not be included

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

The product method is followed in the underdeveloped countries, but it is less reliable because the margin of error in this method is large. In India, this method is applied to agriculture, mining and manufacturing, including handicrafts. 1. Double counting is to be avoided under value added method. Any commodity which is either raw material or intermediate good for the final production should not be included. For example, value of cotton enters value of yarn as cost, and value of yarn in cloth and that of cloth in garments. At every stage value added only should be calculated. 2. The value of output used for self-consumption should be counted while measuring national income. 3. In the case of durable goods, sale and purchase of second hand goods (for example pre owned cars) should not be included.

29. Match the following:

- Labour income 1. Farming

- Capital income 2. dividend

- Mixed income 3. fringe benefits

- 3, 1, 2

- 2, 1, 3

- 3, 2, 1

- 2, 3, 1

Explanation

Factor incomes are grouped under labour income, capital income and mixed income. i) Labour income – Wages and salaries, fringe benefits, employer’s contribution to social security. ii) Capital income – Profit, interest, dividend and royalty iii) Mixed income – Farming, sole proprietorship and other professions.

30. What does (R-P) indicate in National income calculation by income method?

Y = w + r + i + π + (R-P)

- Profits

- Wages

- Rent

- Exports – imports

Explanation

National income is calculated as domestic factor income plus net factor incomes from abroad. In short,

Y = w + r + i + π + (R-P)

w = wages, r = rent, i = interest, π = profits, R = Exports and P = Imports

This method is adopted for estimating the contributions of the remaining sectors, viz., small enterprises, banking and insurance, commerce and transport, professions, liberal arts and domestic service, public authorities, house property and foreign sector transaction. Data on income from abroad (the rest of the world sector or foreign sector) are obtained from the account of the balance of payments of the country.

31. What precaution should be taken for national income calculation by income method?

- Transfer payments are not to be included in estimation of national income as these payments are not received for any services provided in the current year such as pension, social insurance etc.

- Windfall gains such as lotteries should be included as they represent receipts from current productive activity.

- Corporate profit tax should not be separately included as it has been already included as a part of company profit

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

While estimating national income through income method, the following precautions should be taken.

1. Transfer payments are not to be included in estimation of national income as these payments are not received for any services provided in the current year such as pension, social insurance etc. 2. The receipts from the sale of second hand goods should not be treated as part of national income as they do not create new flow of goods or services in the current year. 3. Windfall gains such as lotteries are also not to be included as they do not represent receipts from any current productive activity. 4. Corporate profit tax should not be separately included as it has been already included as a part of company profit.

Items to be included 1. Imputed value of rent for self – occupied houses or offices is to be included. 2. Imputed value of services provided by owners of production units (family labour) is to be included.

32. Which of the following statement about Outlay method is incorrect?

- Under this method, the total expenditure incurred by the society in a particular year is added together.

- To calculate the expenditure of a society, it includes personal consumption expenditure, net domestic investment, etc.

- 1 alone

- 2 alone

- 1, 2

- None

Explanation

In the Expenditure Method (Outlay method) method, the total expenditure incurred by the society in a particular year is added together. To calculate the expenditure of a society, it includes personal consumption expenditure, net domestic investment, government expenditure on consumption as well as capital goods and net exports.

33. Which of the following equation explains Outlay method?

- C + I + G + (X-M)

- C + I + G

- C + I + G + X+M

- C + X + M

Explanation

Symbolically, Outlay method is

GNP = C + I + G + (X-M)

C – Private consumption expenditure I – Private Investment Expenditure G – Government expenditure X-M = Net exports

34. Which of the following are considered as double counting in agricultural and textile industry?

- Seeds

- Fertilizers

- Yarn

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Precautions to be taken for Expenditure Method (Outlay method)

1. Second hand goods: The expenditure made on second hand goods should not be included. 2. Purchase of shares and bonds : Expenditures on purchase of old shares and bonds in the secondary market should not be included. 3. Transfer payments : Expenditures towards payment incurred by the government like old age pension should not be included. 4. Expenditure on intermediate goods : Expenditure on seeds and fertilizers by farmers, cotton and yarn by textile industries are not to be included to avoid double counting. That is only expenditure on final products are to be included.

35. Which of the following are factors of production?

- Land

- Labour

- Entrepreneurship

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

There are a number of inputs that are included into a production process when producing goods and services. These inputs are commonly known as factors of production and include things such as land, labour, capital and entrepreneurship.

36. Which of the following statement is correct?

- Producers of goods and services incur a cost for using these factors of production

- These costs are not added onto the price of the product.

- The factor cost refers to the cost of production that is incurred by a firm when producing goods and services

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Producers of goods and services incur a cost for using these factors of production. These costs are ultimately added onto the price of the product. The factor cost refers to the cost of production that is incurred by a firm when producing goods and services. However, subsidies received are included in the factor cost as subsidies are direct inputs into the production.

37. Which of the following are factors of production?

- Salaries

- cost of obtaining capital

- profit margins

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Examples of production costs include the cost of renting machines, purchasing machinery and land, paying salaries and wages, cost of obtaining capital, and the profit margins that are added by the entrepreneur.

38. Which of the following statement is correct?

- Taxes charged by the government will be added onto the factor price while subsides provided will also be added

- Once goods and services are produced, they are sold in a market place at a set market price

- The market price is the price that consumers will pay for the product when they purchase it from the sellers

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Once goods and services are produced, they are sold in a market place at a set market price. The market price is the price that consumers will pay for the product when they purchase it from the sellers. Taxes charged by the government will be added onto the factor price while subsides provided will be reduced from the factor price to arrive at the market price.

39. What is the formula to calculate market price?

- MP = FC + Indirect Taxes – Subsidies

- MP = FC – Indirect Taxes – Subsidies

- MP = FC + Indirect Taxes + Subsidies

- MP = FC – Indirect Taxes + Subsidies

Explanation

Taxes are added on because taxes are costs that increase the price, and subsidies are reduced because subsidies are already included in the factor cost, and cannot be double counted when market price is calculated. Thus, MP = FC + Indirect Taxes – Subsidies Or, FC = MP – Indirect Taxes + Subsidies

40. What is the equation to calculate Net Indirect Taxes?

- Indirect tax – Subsidies

- Indirect tax + Subsidies

- direct tax – Subsidies

- direct tax + Subsidies

Explanation

National Income (NNPFC) = Gross Value Added by all the production Enterprises within the Domestic Territory of the Country – Depreciation – Net Indirect Taxes + Net Factor Income from Abroad

Net Indirect Taxes = Indirect tax – Subsidies

41. What is the equation to calculate Gross Value Added in calculation of National Income?

- Value of Output +Intermediate Consumption

- Value of Output – Intermediate Consumption

- Closing Stock – Opening Stock

- Sales + Change in Stock

Explanation

Gross Value Added = Value of Output – Intermediate Consumption] Value of Output = Sales + Change in Stock Where, Change in Stock = Closing Stock – Opening Stock

Note: If entire output is sold within the year, then value of output will be equal to sales itself

Value of Output = Price x Quantity Sold

GDPMP = Private Final Consumption + Government Final Consumption Expenditure + Gross Domestic Capital Formation + Net Exports (Exports – Imports)

42. Which of the following is known as accounts of the economy?

- NNP

- National income

- Factor cost

- All the above

Explanation

National income is of great importance for the economy of a country. Nowadays the national income is regarded as accounts of the economy, which are known as social accounts.

43. In Which of the following ways National Income Analysis is useful?

- To formulate the national policies such as monetary policy, fiscal policy and other policies

- To formulate planning and evaluate plan progress

- To know the relative importance of the various sectors of the economy and their contribution towards national income; from the calculation of national income, we could find how income is produced, how it is distributed, how much is spent, saved or taxed

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Importance of National Income Analysis:

1. To know the relative importance of the various sectors of the economy and their contribution towards national income; from the calculation of national income, we could find how income is produced, how it is distributed, how much is spent, saved or taxed.

2. To formulate the national policies such as monetary policy, fiscal policy and other policies; the proper measures can be adopted to bring the economy to the right path with the help of collecting national income data.

3. To formulate planning and evaluate plan progress; it is essential that the data pertaining to a country’s gross income, output, saving and consumption from different sources should be available for economic planning.

4. To build economic models both in short – run and long – run.

44. Which of the following statement is correct about importance of National income analysis?

- To arrive at many Macro Economic variables namely, Tax – GDP ratio, Current Account Deficit – GDP ratio, Fiscal Deficit – GDP ratio, Debt – GDP ratio etc

- To know a country’s per capita income

- To know the distribution of income for various factors of production in the country

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Importance of National Income Analysis:

To make international comparison, inter – regional comparison and inter – temporal comparison of growth of the economy during different periods. To know a country’s per capita income which reflects the economic welfare of the country (Provided income is equally distributed). To know the distribution of income for various factors of production in the country. To arrive at many Macro Economic variables namely, Tax – GDP ratio, Current Account Deficit – GDP ratio, Fiscal Deficit – GDP ratio, Debt – GDP ratio etc.

45. Assertion(A): In India, a special conceptual problem is posed by barter system still prevails for

transacting goods and services.

Reason(R): A proper valuation of output is very difficult in this method

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

In India, a special conceptual problem is posed by the existence of a large, unorganised and non-monetised subsistence sector where the barter system still prevails for transacting goods and services. Here, a proper valuation of output is very difficult.

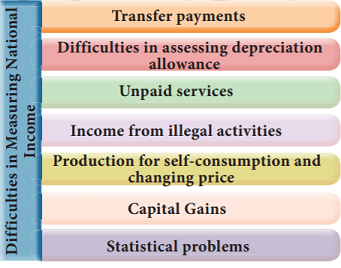

46. Which of the following Difficulties in Measuring National Income?

- Transfer payments

- Income from illegal activities

- paid services

- Capital Gains

- 1, 2, 3

- 1, 2, 4

- 2, 3, 4

- All the above

Explanation

47. Which of the following government expenditure are not included in the national income?

- pensions

- unemployment allowance

- subsidies

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Government makes payments in the form of pensions, unemployment allowance, subsidies, etc. These are government expenditure. But they are not included in the national income. Because they are paid without adding anything to the production processes.

48. Assertion(A): During a year, Interest on national debt is also considered transfer payments

Reason(R): It is paid by the government to individuals and firms on their past savings without

any productive work.

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

During a year, Interest on national debt is also considered transfer payments because it is paid by the government to individuals and firms on their past savings without any productive work.

49. Deduction of which of the following from National income is not an easy task?

- depreciation allowances

- Pension

- accidental damages

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

The deduction of depreciation allowances, accidental damages, repair and replacement charges from the national income is not an easy task. It requires high degree of judgment to assess the depreciation allowance and other charges.

50. Which of the following statement is correct?

- A housewife renders a number of useful services like preparation of meals, serving, tailoring, mending, washing, cleaning, bringing up children, etc

- The reason for the exclusion of her services from national income is that the love and affection of a housewife in performing her domestic work cannot be measured in monetary terms.

- Similarly, there are a number of goods and services which are difficult to be assessed in money terms for the reason stated above, such as rendering services to their friends, painting, singing, dancing, etc.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

A housewife renders a number of useful services like preparation of meals, serving, tailoring, mending, washing, cleaning, bringing up children, etc. She is not paid for them and her services are not directly included in national income. Such services performed by paid servants are included in national income. The reason for the exclusion of her services from national income is that the love and affection of a housewife in performing her domestic work cannot be measured in monetary terms. Similarly, there are a number of goods and services which are difficult to be assessed in money terms for the reason stated above, such as rendering services to their friends, painting, singing, dancing, etc.

51. Assertion(A): Income earned through illegal activities like gambling, smuggling, illicit extraction of liquor, etc., is not included in national income

Reason(R): Such activities have value and satisfy the wants of the people but they are not

considered as productive from the point of view of society.

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

Income earned through illegal activities like gambling, smuggling, illicit extraction of liquor, etc., is not included in national income. Such activities have value and satisfy the wants of the people but they are not considered as productive from the point of view of society.

52. Which of the following statement is correct?

- National income by product method is measured by the value of final goods and services at current market prices

- But prices do not remain stable.

- They rise or fall. To solve this problem, economists calculate the real national income at a constant price level by the consumer price index.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

Farmers keep a large portion of food and other goods produced on the farm for self – consumption. The problem is whether that part of the produce which is not sold in the market can be included in national income or not. National income by product method is measured by the value of final goods and services at current market prices. But prices do not remain stable. They rise or fall. To solve this problem, economists calculate the real national income at a constant price level by the consumer price index.

53. Which of the following are excluded from National income?

- Industries

- Agriculture

- Service

- Capital gains

Explanation

The problem also arises with regard to capital gains. Capital gains arise when a capital asset such as a house, other property, stocks or shares, etc. is sold at higher price than was paid for it at the time of purchase. Capital gains are excluded from national income.

54. Assertion(A): Statistical data may not be perfectly reliable, when they are compiled from

numerous sources

Reason(R): Great care is required to avoid double counting in calculation of national income

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

There are statistical problems, too. Great care is required to avoid double counting. Statistical data may not be perfectly reliable, when they are compiled from numerous sources. Skill and efficiency of the statistical staff and cooperation of people at large are also equally important in estimating national income.

55. Which of the following are statistical problems in national income calculation?

- In animal husbandry, there are no authentic production data available.

- Different languages, customs, etc., also create problems in computing estimates

- Most of the statistical staff are untrained and inefficient.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

The following are the some of the statistical problems: 1. Accurate and reliable data are not adequate, as farm output in the subsistence sector is not completely informed. In animal husbandry, there are no authentic production data available. 2. Different languages, customs, etc., also create problems in computing estimates. 3. People in India are indifferent to the official inquiries. They are in most cases non-cooperative also. 4. Most of the statistical staff are untrained and inefficient.

56. How percent Marginal error will be there in national income calculation?

- 2 %

- 10 %

- 15 %

- 5 %

Explanation

The national income estimates in our country are not very accurate or adequate. There is at least 10 per cent margin of error, i.e., national income is overestimated or underestimated by at least 10 per cent. That is why the GDP estimates for India varies from 2 trillion US dollar to 5 trillion US dollar.

57. Which of the following statement is correct?

- National income is also being measured by the social accounting method

- The social accounting framework is useful for economists as well as policy makers, because it represents the major economic flows and statistical relationships among various sectors of the economic system

- Under this method, the transactions among various sectors such as firms, households, government, etc., are recorded and their interrelationships traced

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

National income is also being measured by the social accounting method. Under this method, the transactions among various sectors such as firms, households, government, etc., are recorded and their interrelationships traced. The social accounting framework is useful for economists as well as policy makers, because it represents the major economic flows and statistical relationships among various sectors of the economic system. It becomes possible to forecast the trends of economy more accurately.

58. In Social Accounting economy is divided into how many sectors?

- 3

- 5

- 2

- 4

Explanation

Under this method, the economy is divided into several sectors. A sector is a group of individuals or institutions having common interrelated economic transactions. The economy is divided into the following sectors (i) Firms, (ii) Households, (iii) Government, (iv) Rest of the world and (v) Capital sector.

59. Which of the following statement is correct?

- “Firms” undertake productive activities

- “Households” are consuming entities and represent the factors of production, who receive payment for services rendered by them to firms

- “Firms” are all organizations which employ the factors of production to produce goods and services

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

“Firms” undertake productive activities. Thus, they are all organizations which employ the factors of production to produce goods and services. “Households” are consuming entities and represent the factors of production, who receive payment for services rendered by them to firms. Households consume the goods and services that are produced by the firms. Thus, firms make payment to households for their services. Households spend money incomes they received on the goods and services produced by the firms. This is a circular flow of money between these two groups.

60. Who defined government as a collective ‘person’ that purchases goods and services from firms?

- Adam Smith

- J.M. Keynes

- Edey and Peacock

- J. M. Llyod

Explanation

“The Government sector” refers to the economic transactions of public bodies at all levels, centre, state and local. In their work concerning social accounting, Edey and Peacock have defined government as a collective ‘person’ that purchases goods and services from firms. These purchases may be financed through taxation, public borrowings, or any other fiscal means. The main function of the government is to provide social goods like defence, public health, education, etc. This means satisfying the collective wants of society. However, public enterprises like Post Offices and railways are separated from the Government sector and included as “Firms”.

61. Which of the following statement is correct?

- “Capital sector” refers to saving and investment activities

- These are included under “Firms”

- It includes the transactions of banks, insurance corporations, financial houses, and other agencies of the money market.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

“Capital sector” refers to saving and investment activities. It includes the transactions of banks, insurance corporations, financial houses, and other agencies of the money market. These are not included under “Firms”. These agencies merely provide financial assistance to the firms’ activities.

“Rest of the world sector” relates to international economic transactions of the country. It contains income, export and import transactions, external loan transaction, and allied overseas investment income and payments.

62. While assessing sectoral contribution to GDP, the economy is divided into____

- 5

- 3

- 2

- 6

Explanation

While assessing sectoral contribution to GDP, the economy is divided into three namely Primary, Secondary and Tertiary sectors.

63. Which of the following statement is correct?

- National Income is considered as an indicator of the economic wellbeing of a country

- A country with a higher per capita income is supposed to enjoy greater economic welfare with a higher standard of living

- The per capita income as an index of economic welfare suffers from limitations

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

National Income is considered as an indicator of the economic wellbeing of a country. The economic progress of countries is measured in terms of their GDP per capita and their annual growth rate. A country with a higher per capita income is supposed to enjoy greater economic welfare with a higher standard of living. But the rise in GDP or per capita income need not always promote economic welfare. The per capita income as an index of economic welfare suffers from limitations.

64. What is considered a better indicator of economic welfare?

- Physical Quality of Life Index

- Gross National Happiness Index

- GDP

- Per capita income

Explanation

Physical Quality of Life Index (PQLI) is considered a better indicator of economic welfare. It includes standard of living, life expectancy at birth and literacy.

65. Assertion(A): For achieving higher GDP, larger natural resources are being depleted or damaged

Reason(R): It is suggested that while assessing national income, loss of natural resources should be subtracted from national income.

- Both (A) and (R) are correct, but (R) does not explain (A)

- Both (A) and (R) are wrong

- Both (A) and (R) are correct and (R) explains (A)

- (A) is Correct and (R) is wrong

Explanation

For achieving higher GDP, larger natural resources are being depleted or damaged. This means reduction of potential for future growth. Hence, it is suggested that while assessing national income, loss of natural resources should be subtracted from national income.

66. Which of the following statement is correct?

- When Indian national income is expressed in terms of US$, the former looks very low

- If Purchasing Power Parity (PPP) method is adopted India looks better.

- While producing economic goods, many environmental and social bads are also generated.

- 1, 2

- 1, 3

- 2, 3

- All the above

Explanation

When Indian national income is expressed in terms of US$, the former looks very low. If Purchasing Power Parity (PPP) method is adopted India looks better. While producing economic goods, many environmental and social bads are also generated. Hence, they also must be considered while enumerating National income.