Development Experiences in India Notes 11th Economics for Tnpsc Exam

Development Experiences in India Notes 11th Economics for Tnpsc Exam

11th Economics Lesson 3 Notes in English

3. Development Experiences in India

“Reform, Perform, Transform”

Introduction

- At the time of Independence in 1947, India was a typically backward economy.

- Owing to poor technological and scientific capabilities, industrialization was limited and lop-sided.

- Agricultural sector exhibited features of feudal and semi-feudal institutions, resulting into low productivity.

- Means of transport and communications were under developed. Educational and health facilities were grossly inadequate and social security measures were virtually non-existent.

- In brief, the country suffered from the twin problems of rampant poverty and widespread unemployment, both resulting in low standard of living.

- The year 1991 is an important landmark in the economic history of post-independent India.

- The country went through a severe economic crisis in the form of serious Balance of Payments problem.

- Indian economy responded to the crisis by introducing a set of policies known as Structural Reforms.

- These policies were aimed at correcting the weaknesses and rigidities in the various sectors of the economy such as Industry, Trade, Fiscal and Agriculture.

11th Economics Book Back Questions

Meaning of Liberalization, Privatization and Globalization (LPG)

- The triple pillars of New Economic Policy are Liberalization, Privatization and Globalization (LPG)

- Liberalization: Liberalization refers to removal of relaxation of governmental restrictions in all stages in industry.

- Delicensing, decontrol, deregulation, subsidies (incentives) and greater role for financial institutions are the various facets of liberalization.

- Privatization: Privatization means transfer of ownership and management of enterprises from public sector to private sector.

- Denationalization, disinvestment and opening exclusive public sector enterprises to private sector are the gateways to privatization.

- Globalization: Globalization refers to the integration of the domestic (Indian) economy with the rest of the world.

- Import liberalization through reduction of tariff and non-tariff barriers, opening the doors to Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) are some of the measures towards globalization.

Arguments in favour of LPG

- Liberalization was necessitated because various licensing policies were said to be deterring the growth of the economy.

- Privatization was necessitated because of the belief that the private sector was not given enough opportunities to earn more money.

- Globalization was necessitated because today a developed country can grow without the help of the under developed countries.

- Natural and human resources of the developing countries are exploited by the developed countries and the developing economies are used as market for the finished goods of the developed countries.

- The surplus capital of the developed countries are invested in backward economies.

- Obsolute and outdated technologies of the developed countries can be easily sold to poor under developed countries.

- Ultimately, the rich countries can grow further at the cost of developing economies.

Arguments against LPG

- Liberalization measures, when effectively enforced, favour an unrestricted entry of foreign companies in the domestic economy.

- Such an entry prevents the growth of the local manufacturers.

- Privatization measures favour the continuance of the monopoly power.

- Only the powerful people can sustain in business markets. Social justice cannot be easily established and maintained.

- As a result, the disparities tend to widen among people and among regions.

- As globalization measures tend to integrate all economies of the world and bringing them all under one umbrella; they pave the way for redistribution of economic power at the world level.

- Only the already well developed countries are favoured in this process and the welfare of the less developed countries will be neglected.

- The economic crisis of the developed countries are easily spread to the developing economies through trade.

- The following are the major changes after 1991:

1. Foreign exchange reserves started rising.

2. There was a rapid industrialization.

3. The pattern of consumption started improving (or deteriorating).

4. Infrastructure facilities such as express highways, metro rails, flyovers and airports started expanding (but the local people were thrown away).

- The benefits of this growth in some sectors have not reached the marginalized sections of the community.

- Moreover, the process of development has generated serious social, economic, political, demographic and ecological issues and challenges.

- Development brings benefits, but which section gets this benefit depends on socio economic structure of the society.

- Despite all these initiatives in the Indian economy, a large section of the people of India continue to face basic economic problems such as poverty, unemployment, discrimination, social exclusion, deprivation, poor healthcare, rising inflation, agricultural stagnation, food insecurity and labour migration.

- However, for these problems, Government policies alone cannot be blamed.

- As new institutional economists suggest, the values, believes, norms etc. of the individuals also matter.

Disinvestment

- Disinvestment means selling of government securities of Public Sector Undertakings (PSUs) to other PSUs or private sectors or banks.

- This process has not been fully implemented.

Relative Position of on Indian Economy

- (This discussion is suitable for a particular period only, there may be changes afterwards)

- According to International Monetary Fund, World Economic Outlook (Ocoter-2016), GDP (nominal) of India in 2016 at current prices was $2,251 billion.

- India contributed 2.99%of total world’s GDP in exchange rate basis. India shared 17.5 percent of the total world population and 2.4 percent of the world surface area.

- India was now 7th largest economy of the world in 2016.

- India was at 3rd position after China and Japan among Asian countries.

- India shared 8.50% of total Asia’s GDP (nominal) in 2016.

Industrial Sector Reforms

- The Prime Minister of India announced the new industrial policy on July 24, 1991.

- The new policy radically liberalized the industrial policy itself and de-regulated the industrial sector substantially.

- The primary objectives of the industrial policy were to promote major industries from the clutches of bureaucrats, to abolish restrictions on foreign direct investment,

- To liberate the indigenous enterprise from the restrictions of MRTP Act, to maintain a sustained growth in productivity and employment and also to achieve international competitiveness.

Important Initiatives by the Government towards

- Industrial Policy The policy has brought changes in the following aspects of industrial regulation:

1. Industrial delicensing

2. Dereservation of the industrial sector

3. Public sector policy (dereservation and reform of PSEs)

4. Abolition of MRTP Act

5. Foreign investment policy and foreign technology policy.

1. Industrial delicensing policy:

- The most important objective of the new industrial policy of 1991 was end of the industrial licensing or the license raj or red tapism.

- Under the industrial licensing policies, private sector firms had to secure licenses to start an industry.

2. Dereservation of the industrial sector

- Previously, the public sector was given reservation especially in the capital goods and key industries.

- Under industrial deregulation, most of the industrial sectors were opened to the private sector as well.

- Under the new industrial policy, only three sectors viz., atomic energy, mining and railways will continue as reserved for public sector.

- All other sectors have been opened for private sector participation.

3. Reforms related to the Public sector enterprises:

- Reforms in the public sector were aimed at enhancing efficiency and competitiveness of the sector.

- The government identified strategic and priority areas for the public sector to concentrate.

- Loss making PSUs were sold to the private sector.

4. Abolition of MRTP Act:

- The New Industrial Policy of 1991 has abolished the Monopoly and Restrictive Trade Practices Act 1969.

- In 2010, the Competition Commission has emerged as the watchdog in monitoring competitive practices in the economy.

- The policy caused big changes including emergence of a strong and competitive private sector and a sizable number of foreign companies in India.

5. Foreign investment policy:

- Another major feature of the economic reform was red carpet welcome to foreign investment and foreign technology.

- This measure has enhanced the industrial competition and improved business environment in the country.

- Foreign investment including FDI and FPI were allowed.

- In 1991, the government announced a specified list of high-technology and high investment priority industries wherein automatic permission was granted for foreign direct investment (FDI) upto 51 percent foreign equity.

- The limit was raised to 74 percent and subsequently to 100 percent for many of these industries.

- Moreover, many new industries have been added to the list over the years.

- Foreign Investment Promotion Board (FIPB) has been set up to negotiate with international firms and approve foreign direct investment in select areas.

Impact of LPG on Agricultural Sector Reforms

- Since the inception of economic reforms, Indian economy has achieved a remarkable rate of growth in industry and service sector.

- However, this growth process bypassed the agricultural sector, which showed sharp deceleration in the growth rate (3.62 percent during 1984/85 – 1995/96 to 1.97 percent in 1995/96 – 2004/05).

- The sector has recorded wide variations in yield and productivity and there was a shift towards cash crop cultivation.

- Moreover, agricultural indebtedness pushed several farming households into poverty and some of them resorted to extreme measures like suicides.

Crop Insurance

- Agriculture in India is highly prone to risks like droughts and floods.

- It is necessary to protect the farmers from natural calamities and ensure their credit eligibility for the next season.

- For this purpose, the Government of India introduced many agricultural schemes throughout the country.

- The Pradhan Mantri Fasal Bima Yojana (Prime Minister’s Crop Insurance Scheme) was launched on 18 February 2016.

- It envisages a uniform premium of only 2 percent to be paid by farmers for Kharif crops and 1.5 percent for Rabi crops.

- The premium for (annual) commercial and horticultural crops will be 5 percent.

Cold Storage

- India is the largest producer of fruits and second largest producer of vegetables in the world.

- In spite of that per capita availability of fruits and vegetables is quite low because of post harvest losses which account for about 25% to 30% of production.

- Besides, quality of a sizable quantity of produce also deteriorates by the time it reaches the consumer.

- Most of the problems relating to the marketing of fruits and vegetables can be traced to their perishability.

- Perishability is responsible for high marketing costs, market gluts, price fluctuations and other similar problems.

- In order to overcome this constraint, the Government of India and the Ministry of Agriculture promulgated an order known as “Cold Storage Order, 1964” under Section 3 of the Essential Commodities Act, 1955.

- However, the cold storage facility is still very poor and highly inadequate.

Post Harvest measures

- The annual value of harvest and postharvest losses of major agricultural produce at national level was of the order of Rs.92,651 crores, calculated using production data of 2012-13 at 2014 and wholesale prices, estimated by the Indian Council of Agricultural Research (ICAR).

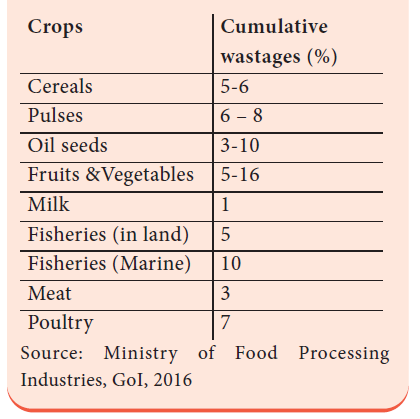

FOOD ITEM WASTE PERCENTAGE

Kisan Credit Card Scheme

- A Kisan Credit Card (KCC) is a credit delivery mechanism that is aimed at enabling farmers to have quick and timely access to affordable credit.

- It was launched in 1998 by the Reserve Bank of India and NABARD.

- The scheme aims to reduce farmer dependence on the informal banking sector for credit – which can be very expensive and suck them into a debt spiral.

- The card is offered by cooperative banks, regional rural banks and public sector banks.

- Based on a review of the working of the KCC, the government has advised banks to convert the KCC into a smart card cum debit card.

- In order to reduce wastage of agricultural produce and minimize post-harvest losses, the Ministry of Food Processing Industries (MoFPI) has implemented various components of Central Sector Schemes, namely:

- Mega Food Parks; Integrated Cold Chain; Value Addition Preservation Infrastructure; Modernization of Slaughter house Scheme for Quality Assurance; Codex Standards; Research and Development and Other promotional activities.

- Further, the GoI extended support to arrest post harvest losses of horticulture and non-horticulture produce and to provide integrated cold chain and preservation infrastructure facilities from the farm gate to the consumer or from the production site to the market since 2008-09.

- However, the improvement is not visible for it is not substantial.

Agricultural Produce Market Committee

- Agricultural Produce Market Committee (APMC) is a statutory body constituted by state government in order to trade in agricultural or horticultural or livestock products.

Functions of APMC

- Functions of APMC are:

- 1. To promote public private partnership in the ambit of agricultural markets.

- 2. To provide market led extension services to farmer.

- 3. To bring transparency in pricing system and transactions taking place in market in a transparent manner.

- 4. To ensure payments to the farmers for the sale of agricultural produce on the same day.

- 5. To promote agricultural activities.

- 6. To display data on arrivals and rates of agricultural produce from time to time into the market.

Agrarian Crisis after Reforms

a) High input Costs:

- The biggest input for farmers is seeds. Before liberalisation, farmers across the country had access to seeds from state government institutions.

- The institutions produced own seeds and were responsible for their quality and price.

- With liberalization, India’s seed market was opened up to global agribusinesses.

- Also, following the deregulation many state government institutions were closed down in 2003.

- These hit farmers doubly hard: seed prices shot up, and fake seeds made an appearance in a big way.

b) Cutback in agricultural subsidies:

- Farmers were encouraged to shift from growing a mixture of traditional crops to export oriented ‘cash crops’ like chill, cotton and tobacco. Liberalisation policies reduced the subsides on pesticide, fertilizer and elasticity.

- As a result prices have increased by 300%.

- However, the prices of agricultural goods have not increased to that extent.

c) Reduction of import duties:

- With a view to open India’s markets, the liberalization reforms also withdrew tariffs and duties on imports.

- By 2001, India completely removed restrictions on imports of almost 1,500 items including food.

- As a result, cheap imports flooded the market, pushing prices of crops like cotton and pepper down.

d) Paucity of credit facilities:

- After 1991 the lending pattern of commercial banks, including nationalised bank drastically changed.

- As a result, loan was not easily adequate. This has forced the farmers to rely on moneylenders who charge exorbitant rate of interest.

Trade Reforms:

- Trade Policy Reforms: The main features of the new trade policy as it has evolved over the years since 1991 are as follows:

- Free imports and exports: Prior to 1991, in India imports were regulated.

- From 1992, imports were regulated by a limited negative list.

- For instance, the trade policy of 1 April 1992 freed imports of almost all intermediate and capital goods. Only 71 items remained restricted.

- This would affect the domestic industries.

- Rationalization of tariff structure and removal of quantitative restrictions:

- The Chelliah Committee’s Report had suggested drastic reduction in import duties.

- It had suggested a peak rate of 50 percent.

- As a first step towards a gradual reduction in the tariffs, the 1991-92 budget had reduced the peak rate of import duty from more than 300 percent to 150 percent.

- The process of lowering the customs tariffs was carried further in successive budgets. This also affected the domestic industries.

Export and Import Policy

- The Government of India, Ministry of Commerce and Industry announced New Foreign Trade Policy on 01st April 2015 for the period of 2015-2020.

Salient Features of “EXIM POLICY (2015-2020)”

- The new EXIM policy has been formulated focusing on increasing in exports scenario, boosting production and supporting the concepts like Make in India and Digital India.

- Reduce export obligations by 25% and give boost to domestic manufacturing supporting the “Make in India” concept.

- As a step to Digital India concept, online procedure to upload digitally signed document by CA/CS/Cost Accountant are developed and further mobile app for filing tax, stamp duty has been developed.

- Repeated submission of physical copies of documents available on Exporter Importer Profile is not required.

- Export obligation period for export items related to defence, military store, aerospace and nuclear energy to be 24 months.

- EXIM Policy 2015-2020 is expected to double the share of India in World Trade from present level of 3% by the year 2020.

- This appears to be too ambitions.

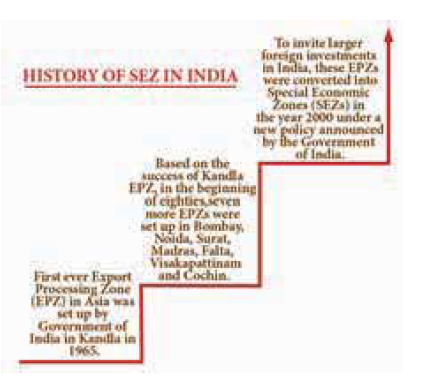

Special Economic Zones

- With a view to overcome the shortcomings experienced on account of the multiplicity of controls and clearances, absence of world-class infrastructure, and an unstable fiscal regime and with a view to attract larger foreign investments in India, the Special Economic Zones (SEZs) Policy was announced in April 2000.

- As part of the economic reforms, the system of taking over land by the government for commercial and industrial purposes was introduced in the country.

- As per the Special Economic Zones Act of 2005, the government has so far notified about 400 such zones in the country.

- Since the SEZ deprives the farmers of their land and livelihood, it is harmful to agriculture.

- In order to promote export and industrial growth in line with globalisation the SEZ was introduced in many countries.

- India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia’s first EPZ set up in Kandla in 1965.

- The broad range of SEZ covers free trade zones, export processing zones, industrial parks, economic and technology development zones, high-tech zones, science and innovation parks, free ports, enterprise zones, and others.

Major Objectives of SEZs

- To enhance foreign investment, especially to attract foreign direct Development Experiences in India 198 9.9 investment (FDI) and thereby increasing GDP.

- To increase shares in Global Export (International Business).

- To generate additional economic activity.

- To create employment opportunities.

- To develop infrastructure facilities.

- To exchange technology in the global market.

Main Characteristics of SEZ

- Geographically demarked area with physical security

- Administrated by single body/ authority

- Streamlined procedures

- Having separate custom area

- Governed by more liberal economic laws.

- Greater freedom to the firms located in SEZs.

- As a result, they need not respect the Government’s rules and regulations.

- The social and environmental impacts were disastrous.

Fiscal Reforms

- A key element in the stabilization effort was to restore fiscal discipline.

- It means reduction of fiscal deficit to the extent of just 3% of GDP, as suggested by Fund Bank Policies.

- In this way, the budget aimed at containing government expenditure and augmenting revenues; reversing the downtrend in the share of direct taxes to total tax revenues and curbing conspicuous consumption.

- Some of the important policy initiatives introduced for correcting the fiscal imbalance were:

- Reduction in fertilizer subsidy, abolition of subsidy on sugar and disinvestment of a part of the government’s equity holdings in select public sector undertakings.

- Gradually expenditures on welfare measures were reduced; takes on corporate sectors were reduced; and takes on poor people were increased.

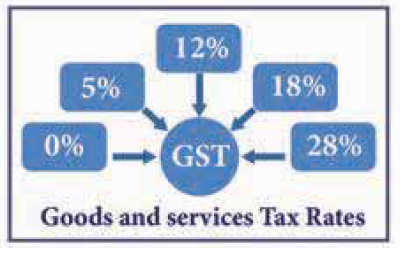

Goods and Services Tax (GST)

- Goods and Services Tax (GST) is defined as the tax levied when a consumer buys a good or service.

- It is proposed to be a comprehensive indirect tax levied on manufacture, sale and consumption of goods as well as services.

- GST aims to replace all indirect taxes levied on goods and services by the Indian Central and State governments.

- GST would eliminatie the cascading effect of taxes on the production and distribution of goods and services.

- It is also a “one-point tax” Unlike VAT which was a multipoint tax.

- The Goods and Service Tax Act was passed in the Parliament on 29th March 2017.

- The Act came into effect on 1st July 2017.

- The motto is one nation, one market, one tax.

Current GST Rates in India

Advantages of GST

- Removing cascading tax effect

- Single point tax

- Higher threshold for registration

- Composition scheme for small business

- Online simpler procedure under GST

- Defined treatment for e-ecommerce

- Increased efficiency in logistics

- Regulating the unorganized sector

Monetary and Financial Sector Reforms

- Monetary reforms aimed at doing away with interest rate distortions and rationalizing the structure of lending rates.

- The new policy tried in many ways to make the banking system more efficient. Some of the measures undertaken were:

- Reserve Requirements: Reduction in statutory liquidity ratio (SLR) and the cash reserve ratio (CRR) were recommended by the Narasimham Committee Report, 1991.

- It was proposed to cut down the SLR from 38.5 percent to 25 percent within a time span of three years.

- Similarly, it was proposed that the CRR be brought down to 3 to 5% over a period of four years.

- Interest Rate Liberalisation:

- Earlier, RBI controlled

- the interest rates payable on deposits,

- the interest rates which could be charged for bank loans.

- Greater competition among public sector, private sector and foreign banks and elimination of administrative constraints.

- Liberalisation of bank branch licensing policy in order to rationalize the existing branch network.

- Banks were given freedom to relocate branches and open specialized branches f. Guidelines for opening new private sector banks.

- New accounting norms regarding classification of assets and provisions of bad debt were introduced in tune with the Narasimham Committee Report.

Conclusion

- There is no doubt that the Indian economy recorded ample achievements in some sectors after new economic policy.

- If the size of an economy provides the first impression of a country’s political and economic strength, then India has indeed grown since 1991.

- In dollar terms, India’s GDP crossed the $2-trillion mark in 2015-16.

- Currently, the country is ranked ninth in the world in terms of nominal GDP.

- Once India was rebuked for its “Hindu rate of growth”, a term used by Rajkrishna to refer to low rate of economic growth.

- The GDP growth rate of India is very much appreciated.

- This growth is also due to changes in accounting system.

- That is why the increased GDP growth rate has failed to alleviate the miseries of the common people and to reduce the socio, economic and environmental imbalances.

- The basic problems of unemployment, poverty, ill-health and inequalities remain unsolved.