Banking Notes 12th Economics

12th Economics Lesson 6 Notes in English

6. Banking

| “Commercial Banks are the institutions that make short term loans to business and in the process create Money” – Culbertson |

Introduction

- Finance is the life blood of all economic activities such as trade, commerce, agriculture and industry.

- A bank is generally understood as an institution which provides fundamental financial services such as accepting deposits and lending loans.

- Banking sector acts as the backbone of modern business world.

- The banking system significantly contributes for the development of any country.

- Due to the importance in the financial stability of a country, banks are highly regulated in most countries.

Historical Development

- The Ricks Banks of Sweden, which had sprung from a private bank established in 1656 is the oldest central bank in the world.

- It acquired the sole right of note issue in 1897.

- But the fundamentals of the art of banking have been developed by the Bank of England (1864) as the first bank of issues.

- A large number of central banks were established between 1921 and 1954 in compliance with the resolution passed by the International Finance Conference held at Brussels in 1920.

- The South African Reserve Bank (1921), the Central Bank of China (1928), The Reserve Bank of New Zealand (1934), The Reserve Bank of India (1935), the Central Bank of Ceylon (1950) and the Bank of Israel (1954) were established.

Commercial banks

- Commercial bank refers to a bank, or a division of a large bank, which more specifically deals with deposit and loan services provided to corporations or large/ middle-sized business – as opposed to individual members of the public/small business.

- They do not provide, long-term credit, as liquidity of assets is to be maintained.

Functions of Commercial Banks:

- Commercial banks are institutions that conduct business with profit motive by accepting public deposits and lending loans for various investment purposes.

- The functions of commercial banks are broadly classified into primary functions and secondary functions, which are shown in the picture

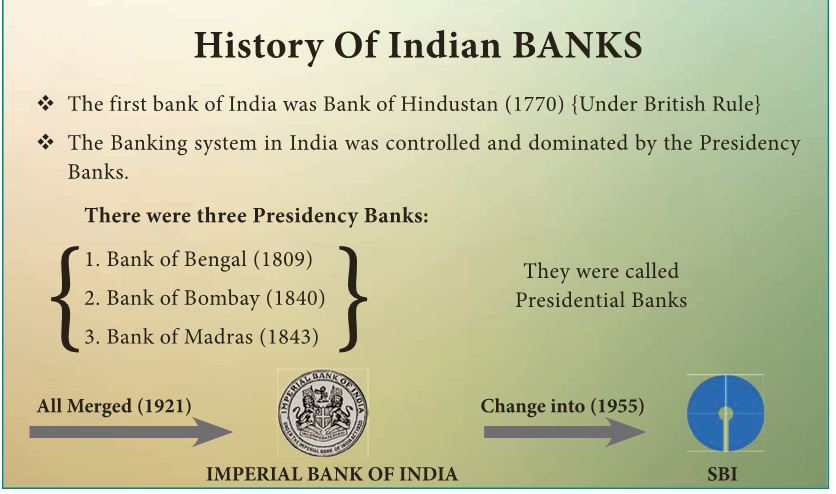

History of Indian BANKS

- The first bank of India was Bank of Hindustan (1770) {Under British Rule}

- The Banking system in India was controlled and dominated by the Presidency Banks.

- There were three Presidency Banks:

- Bank of Bengal (1809)

- Bank of Bombay (1840)

- Bank of Madras (1843)

- They were called Presidential Banks

Functions of Commercial Banks

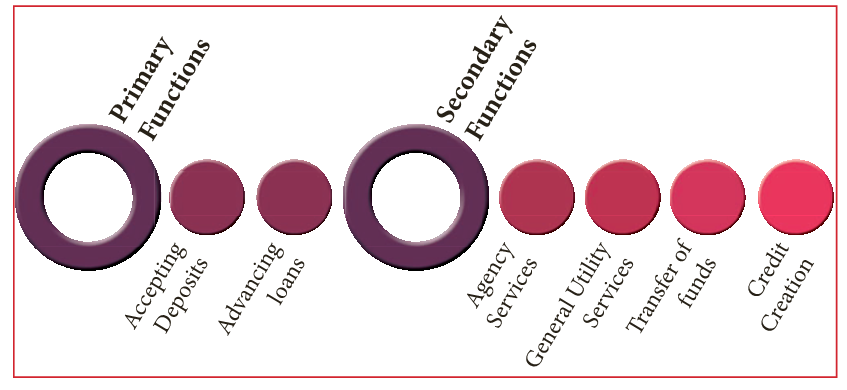

(a) Primary Functions:

1. Accepting Deposits

- It implies that commercial banks are mainly dependent on public deposits.

- There are two types of deposits, which are discussed as follows

(i) Demand Deposits

- It refers to deposits that can be withdrawn by individuals without any prior notice to the bank.

- In other words, the owners of these deposits are allowed to withdraw money anytime by writing a withdrawal slip or a cheque at the bank counter or from ATM centres using debit card.

(ii) Time Deposits

- It refers to deposits that are made for certain committed period of time.

- Banks pay higher interest on time deposits.

- These deposits can be withdrawn only after a specific time period by providing a written notice to the bank.

2. Advancing Loans

- It refers to granting loans to individuals and businesses.

- Commercial banks grant loans in the form of overdraft, cash credit, and discounting bills of exchange.

(b) Secondary Functions

- The secondary functions can be classified under three heads, namely, agency functions, general utility functions, and other functions.

1. Agency Functions:

- It implies that commercial banks act as agents of customers by performing various functions.

(i) Collecting Cheques

- Banks collect cheques and bills of exchange on the behalf of their customers through clearing house facilities provided by the central bank.

(ii) Collecting Income

- Commercial banks collect dividends, pension, salaries, rents, and interests on investments on behalf of their customers.

- A credit voucher is sent to customers for information when any income is collected by the bank.

(iii) Paying Expenses

- Commercial banks make the payments of various obligations of customers, such as telephone bills, insurance premium, school fees, and rents.

- Similar to credit voucher, a debit voucher is sent to customers for information when expenses are paid by the bank.

(2) General Utility Functions:

- It implies that commercial banks provide some utility services to customers by performing various functions.

(i) Providing Locker Facilities

- Commercial banks provide locker facilities to its customers for safe custody of jewellery, shares, debentures, and other valuable items.

- This minimizes the risk of loss due to theft at homes.

- Banks are not responsible for the items in the lockers.

(ii) Issuing Traveler’s

- Cheques Banks issue traveler’s cheques to individuals for traveling outside the country.

- Traveler’s cheques are the safe and easy way to protect money while traveling.

(iii) Dealing in Foreign Exchange

- Commercial banks help in providing foreign exchange to businessmen dealing in exports and imports.

- However, commercial banks need to take the permission of the Central Bank for dealing in foreign exchange.

3. Transferring Funds

- It refers to transferring of funds from one bank to another.

- Funds are transferred by means of draft, telephonic transfer, and electronic transfer.

4. Letter of Credit

- Commercial banks issue letters of credit to their customers to certify their creditworthiness.

(i) Underwriting Securities

- Commercial banks also undertake the task of underwriting securities.

- As public has full faith in the creditworthiness of banks, public do not hesitate in buying the securities underwritten by banks.

(ii) Electronic Banking

- It includes services, such as debit cards, credit cards, and Internet banking.

(C) Other Functions:

(i) Money Supply

- It refers to one of the important functions of commercial banks that help in increasing money supply.

- For instance, a bank lends Rs 5lakh to an individual and opens a demand deposit in the name of that individual.

- Bank makes a credit entry of Rs 5lakh in that account.

- This leads to creation of demand deposits in that account.

- The point to be noted here is that there is no payment in cash.

- Thus, without printing additional money, the supply of money is increased.

(ii) Credit Creation Credit

- Creation means the multiplication of loans and advances.

- Commercial banks receive deposits from the public and use these deposits to give loans.

- However, loans offered are many times more than the deposits received by banks.

- This function of banks is known as ‘Credit Creation’.

(iii) Collection of Statistics:

- Banks collect and publish statistics relating to trade, commerce and industry.

- Hence, they advice customers and the public authorities on financial matters.

Mechanism / Technique of Credit Creation by Commercial Banks

- Bank credit refers to bank loans and advances.

- Money is said to be created when the banks, through their lending activities, make a net addition to the total supply of money in the economy.

- Likewise, money is said to be destroyed when the loans are repaid by the borrowers to the banks and consequently the credit already created by the banks is wiped out in the process.

- Banks have the power to expand or contract demand deposits and they exercise this power through granting more or less loans and advances and acquiring other assets.

- This power of commercial bank to create deposits through expanding their loans and advances is known as credit creation.

Primary / Passive Deposit and Derived / Active Deposit

- The modern banks create deposits in two ways.

- They are primary deposit and derived deposit.

- When a customer gives cash to the bank and the bank creates a book debt in his name called a deposit, it is known as a “primary deposit”.

- But when such a deposit is created, without there being any prior payment of equivalent cash to the bank, it is called a ‘derived deposit’.

- Credit Creation literally means the multiplication of loans and advances.

- Every loan creates its own deposits.

- Central Bank insists the banks to maintain a ratio between the total deposits they create and the cash in their possession.

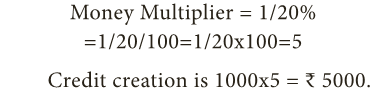

- For the purpose of understanding, it is assumed that all banks are obliged to keep the ratio between cash and its deposits at a minimum of 20 percent.

- The banks do not keep any excess reserves, in other words, it would exhaust possible avenues of income earning activities like giving loans etc. up to the maximum extent after attaining the minimum cash reserves.

- There are no drains in the supply of money i,e., the public do not suddenly want to hold more ideal currency or withdraw from the time deposits.

- Under the above assumptions, when a customer deposits a sum of Rs1000 in a bank, the bank creates a deposit of Rs1000 in his favor.

- Bank deposits (Bank Money) have increased by Rs1000.

- But, at this stage, there is no increase in the total supply of money with the public, because the above extra bank money of Rs1000 is offset by the cash of Rs1000 deposited in the bank.

- The bank has now additional cash of Rs1000 in its custody. Since it is required to keep only a cash reserve of 20 per cent, this means that Rs800 is excess cash reserve with it.

- According to the above assumption, the bank should lend out this Rs 800 to the public.

- Suppose, it does so, and the debtor deposits the money in his own account with another bank B, Bank is creating a deposit of Rs800. Bank B then has also excess cash reserve of Rs 640(800-160).

- It could, in its turn, lend out Rs 640. This Rs640 will, in its turn find its way with, say Bank C; it will create a deposit of Rs640and so on.

- The total deposits will now grow into Rs1000+800+640+…….till ultimately the excess cash reserve peters out.

- It can be shown that when that stage is reached the total of the above will be Rs5000.

- Money Multiplier = 1/20% =1/20/100=1/20×100=5 Credit creation is 1000×5 = Rs5000.

Role of Commercial Banks in Economic Development of a Country

1. Capital Formation

- Banks play an important role in capital formation, which is essential for the economic development of a country.

- They mobilize the small savings of the people scattered over a wide area through their network of branches all over the country and make it available for productive purposes.

- Now-a-days, banks offer very attractive schemes to induce the people to save their money with them and bring the savings mobilized to the organized money market.

- If the banks do not perform this function, savings either remains idle or used in creating other assets, (eg. gold) which are low in scale of plan priorities.

Role of Commercial Banks

- Capital Formation

- Creation of Credit

- Channelizing the funds

- Encouraging Rights Type of Industries

- Banks Monetize Debt

- Finance to Government

- Employment Generation

- Bank Promote Entrepreneurship

2. Creation of Credit

- Banks create credit for the purpose of providing more funds for development projects.

- Credit creation leads to increased production, employment, sales and prices and thereby they bring about faster economic development.

3. Channelizing the Funds towards

- Productive Investment Banks invest the savings mobilized by them for productive purposes.

- Capital formation is not the only function of commercial banks.

- Pooled savings should be allocated to various sectors of the economy with a view to increase the productivity.

- Then only it can be said to have performed an important role in the economic development.

4. Encouraging Right Type of Industries

- Many banks help in the development of the right type of industries by extending loan to right type of persons.

- In this way, they help not only for industrialization of the country but also for the economic development of the country.

- They grant loans and advances to manufacturers whose products are in great demand.

- The manufacturers in turn increase their products by introducing new methods of production and assist in raising the national income of the country.

- Sometimes, sub-prime lending is also clone.

- That is how there was an economic crisis in the year 2007-08 in the US.

5. Banks Monetize Debt

- Commercial banks transform the loan to be repaid after a certain period into cash, which can be immediately used for business activities.

- Manufacturers and wholesale traders cannot increase their sales without selling goods on credit basis.

- But credit sales may lead to locking up of capital.

- As a result, production may also be reduced.

- As banks are lending money by discounting bills of exchange, business concerns are able to carry out the economic activities without any interruption.

6. Finance to Government

- Government is acting as the promoter of industries in underdeveloped countries for which finance is needed for it.

- Banks provide long-term credit to Government by investing their funds in Government securities and short-term finance by purchasing Treasury Bills.

- RBI has given Rs 68,000 crores to the government of India in the year 2018-19, this is 99% the RBI’s surplus.

7. Employment Generation

- After the nationalization of big banks, banking industry has grown to a great extent.

- Bank’s branches are opened frequently, which leads to the creation of new employment opportunities.

8. Banks Promote Entrepreneurship

- In recent days, banks have assumed the role of developing entrepreneurship particularly in developing countries like India by inducing new entrepreneurs to take up the well-formulated projects and provision of counselling services like technical and managerial guidance.

- Banks provide 100% credit for worthwhile projects, which is also technically feasible and economically viable.

- Thus commercial banks help for the development of entrepreneurship in the country.

Non-Banking Financial Institution (NBFI)

- A non-banking financial institution (NBFI) or non-bank financial company (NBFC) is a financial institution that does not have a full banking license or is not supervised by the central bank.

- The NBFIs do not carry on pure banking business, but they will carry on other financial transactions.

- They receive deposits and give loans.

- They mobilize people’s savings and use the funds to finance expenditure on investment activities.

- In short, they are institutions which undertake borrowing and lending.

- They operate in both the money and the capital markets.

- NBFIs can be broadly classified into two categories. Viz..,

- Stock Exchange; and

- Other Financial institutions.

- Under the latter category comes Finance Companies, Finance Corporations, ChitFunds, Building Societies, Issue Houses, Investment Trusts and Unit Trusts and Insurance Companies.

Central Bank

- A central bank, reserve bank, or monetary authority is an institution that manages a state’s currency, money supply, and interest rates.

- Central banks also usually oversee the commercial banking system of their respective countries.

Functions of Central Bank (Reserve Bank of India)

- The Reserve Bank of India (RBI) is India’s central banking institution, which controls the monetary policy of the Indian rupee.

- It commenced its operations on 1 April 1935 in accordance with the Reserve Bank of India Act, 1934.

- The original share capital was divided into shares of Rs100 each fully paid, which were initially owned entirely by private shareholders.

- Following India’s independence on 15 August 1947, the RBI was nationalised on 1 January 1949.

1. Monetary Authority:

- It controls the supply of money in the economy to stabilize exchange rate, maintain healthy balance of payment, attain financial stability, control inflation, strengthen banking system.

2. The issuer of currency:

- The objective is to maintain the currency and credit system of the country.

- It is the sole authority to issue currency.

- It also takes action to control the circulation of fake currency.

3. The issuer of Banking License:

- As per Sec 22 of Banking Regulation Act, every bank has to obtain a banking license from RBI to conduct banking business in India.

4. Banker to the Government:

- It acts as banker both to the central and the state governments. It provides short- term credit.

- It manages all new issues of government loans, servicing the government debt outstanding and nurturing the market for government securities.

- It advises the government on banking and financial subjects.

5. Banker’s Bank:

- RBI is the bank of all banks in India as it provides loan to banks, accept the deposit of banks, and rediscount the bills of banks.

6. Lender of last resort:

- The banks can borrow from the RBI by keeping eligible securities as collateral at the time of need or crisis, when there is no other source.

7. Act as clearing house:

- For settlement of banking transactions, RBI manages 14 clearing houses.

- It facilitates the exchange of instruments and processing of payment instructions.

8. Custodian of foreign exchange reserves:

- It acts as a custodian of FOREX. It administers and enforces the provision of Foreign Exchange Management Act (FEMA), 1999.

- RBI buys and sells foreign currency to maintain the exchange rate of Indian rupee v/s foreign currencies.

9. Regulator of Economy:

- It controls the money supply in the system, monitors different key indicators like GDP, Inflation, etc.

10. Managing Government securities:

- RBI administers investments in institutions when they invest specified minimum proportions of their total assets/liabilities in government securities.

11. Regulator and Supervisor of Payment and Settlement Systems:

- The Payment and Settlement Systems Act of 2007 (PSS Act) gives RBI oversight authority for the payment and settlement systems in the country.

- RBI focuses on the development and functioning of safe, secure and efficient payment and settlement mechanisms.

12. Developmental Role:

- This role includes the development of the quality banking system in India and ensuring that credit is available to the productive sectors of the economy.

- It provides a wide range of promotional functions to support national objectives.

- It also includes establishing institutions designed to build the country’s financial infrastructure.

- It also helps in expanding access to affordable financial services and promoting financial education and literacy.

13. Publisher of monetary data and other data:

- RBI maintains and provides all essential banking and other economic data, formulating and critically evaluating the economic policies in India.

- RBI collects, collates and publishes data regularly.

14. Exchange manager and controller:

- RBI represents India as a member of the International Monetary Fund [IMF].

- Most of the commercial banks are authorized dealers of RBI.

15. Banking Ombudsman Scheme:

- RBI introduced the Banking Ombudsman Scheme in 1995.

- Under this scheme, the complainants can file their complaints in any form, including online and can also appeal to the Ombudsman against the awards and the other decisions of the Banks.

16. Banking Codes and Standards Board of India:

- To measure the performance of banks against Codes and standards based on established global practices, the RBI has set up the Banking Codes and Standards Board of India (BCSBI).

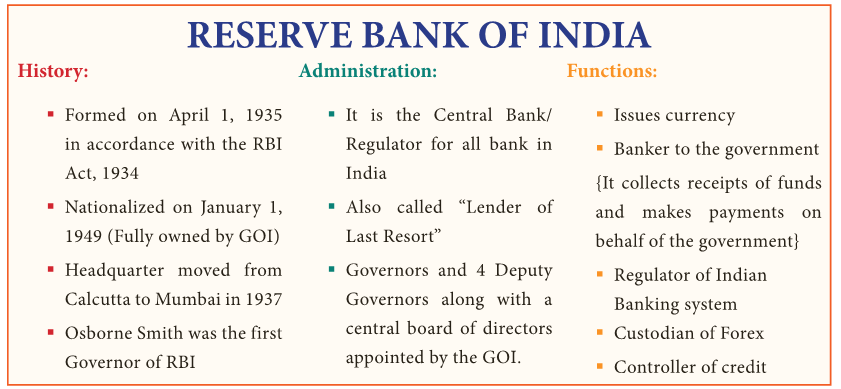

RESERVE BANK OF INDIA

History:

- Formed on April 1, 1935 in accordance with the RBI Act, 1934

- Nationalized on January 1, 1949 (Fully owned by GOI)

- Headquarter moved from Calcutta to Mumbai in 1937

- Osborne Smith was the first Governor of RBI

Administration:

- It is the Central Bank/ Regulator for all bank in India

- Also called “Lender of Last Resort”

- Governors and 4 Deputy Governors along with a central board of directors appointed by the GOI.

Functions:

- Issues currency

- Banker to the government {It collects receipts of funds and makes payments on behalf of the government}

- Regulator of Indian Banking system

- Custodian of Forex

- Controller of credit

- The process of issuing paper currency was started in the 18th century. Private Banks such as the bank of Bengal the bank of Bombay and the Bank of Madras – first printed paper money.

- The first rupee was introduced by Sher Shah Suri based on a ratio of 40 copper pieces (paisa) per rupee.

- The name was derived from the Sanskrit word Raupya, meaning silver.

- Each banknote has its amount written in 17 languages (English and Hindi on the front and 15 other on the back) illustrating the diversity of the country.

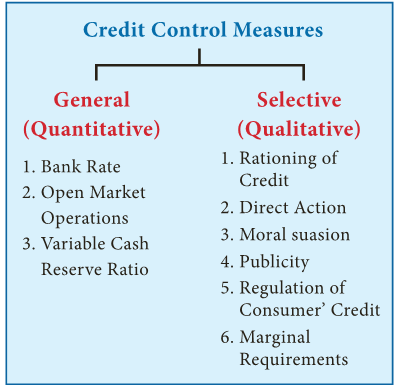

Credit Control Measures

- Credit control is the primary mechanism available to the Central banks to realize the objectives of monetary management.

- The RBI is much better placed than many of credit control.

- The statutory basis for the control of the credit system by the Reserve Bank is embodied in the Reserve Bank of India Act, 1934 and the Banking Regulation Act, 1949.

Methods of Credit Control

I. Quantitative or General Methods:

1. Bank Rate Policy:

- The bank rate is the rate at which the Central Bank of a country is prepared to re-discount the first class securities.

- It means the bank is prepared to advance loans on approved securities to its member banks.

- As the Central Bank is only the lender of the last resort the bank rate is normally higher than the market rate.

- For example: If the Central Bank wants to control credit, it will raise the bank rate.

- As a result, the deposit rate and other lending rates in the money-market will go up.

- Borrowing will be discouraged, and will lead to contraction of credit and vice versa.

2. Open Market Operations:

- In narrow sense, the Central Bank starts the purchase and sale of Government securities in the money market.

- In Broad Sense, the Central Bank purchases and sells not only Government securities but also other proper eligible securities like bills and securities of private concerns.

- When the banks and the private individuals purchase these securities they have to make payments for these securities to the Central Bank.

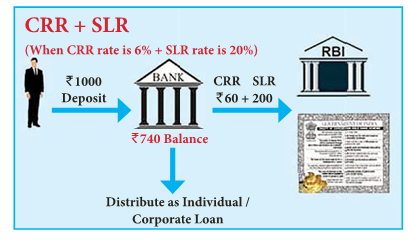

3. Variable Reserve Ratio:

a) Cash Reserves Ratio:

- Under this system the Central Bank controls credit by changing the Cash Reserves Ratio.

- For example, if the Commercial Banks have excessive cash reserves on the basis of which they are creating too much of credit, this will be harmful for the larger interest of the economy.

- So it will raise the cash reserve ratio which the Commercial Banks are required to maintain with the Central Bank.

- Similarly, when the Central Bank desires that the Commercial Banks should increase the volume of credit in order to bring about an economic revival in the economy.

- The central Bank will lower down the Cash Reserve Ratio with a view to expand the lending capacity of the Commercial Banks.

- Variable Cash Reserve Ratio as an objective of monetary policy was first suggested by J.M. Keynes.

- It was first followed by Federal Reserve System in United States of America.

- The commercial banks as per the statute has to maintain reserves based on their demand deposit and fixed deposit with central bank is called as Cash Reserve Ratio.

- If the CRR is high, the commercial bank’s capacity to create credit will be less and if the CRR is low, the commercial bank’s capacity to create credit will be high.

b) Statutory Liquidity Ratio:

- Statutory Liquidity Ratio (SLR) is the amount which a bank has to maintain in the form of cash, gold or approved securities.

- The quantum is specified as some percentage of the total demand and time liabilities (i.e., the liabilities of the bank which are payable on demand anytime, and those liabilities which are accruing in one month’s time due to maturity) of a bank.

II. Qualitative or Selective Method of Credit Control:

- The qualitative or the selective methods are directed towards the diversion of credit into particular uses or channels in the economy.

- Their objective is mainly to control and regulate the flow of credit into particular industries or businesses.

- The following are the frequent methods of credit control under selective method:

- Rationing of Credit

- Direct Action

- Moral Persuasion

- Method of Publicity

- Regulation of Consumer’s Credit

- Regulating the Marginal Requirements on Security Loans

1. Rationing of Credit

- This is the oldest method of credit control.

- Rationing of credit as an instrument of credit control was first used by the Bank of England by the end of the 18th Century.

- It aims to control and regulate the purposes for which credit is granted by commercial banks.

- It is generally of two types.

a) The variable portfolio ceiling:

- It refers to the system by which the central bank fixes ceiling or maximum amount of loans and advances for every commercial bank.

b) The variable capital asset ratio:

- It refers to the system by which the central bank fixes the ratio which the capital of the commercial bank should have to the total assets of the bank.

2. Direct Action

- Direct action against the erring banks can take the following forms.

- The central bank may refuse to altogether grant discounting facilities to such banks.

- The central bank may refuse to sanction further financial accommodation to a bank whose existing borrowing are found to be in excess of its capital and reserves.

- The central bank may start charging penal rate of interest on money borrowed by a bank beyond the prescribed limit.

3. Moral Suasion

- This method is frequently adopted by the Central Bank to exercise control over the Commercial Banks.

- Under this method Central Bank gives advice, then requests and persuades the Commercial Banks to co-operate with the Central Bank in implementing its credit policies.

4. Publicity

- Central Bank in order to make their policies successful, take the course of the medium of publicity.

- A policy can be effectively successful only when an effective public opinion is created in its favour.

5. Regulation of Consumer’s Credit:

- The down payment is raised and the number of installments reduced for the credit sale.

6. Changes in the Marginal Requirements on Security Loans:

- This system is mostly followed in U.S.A.

- Under this system, the Board of Governors of the Federal Reserve System has been given the power to prescribe margin requirements for the purpose of preventing an excessive use of credit for stock exchange speculation.

- This system is specially intended to help the Central Bank in controlling the volume of credit used for speculation in securities under the Securities Exchange Act, 1934.

- The Repo Rate and the Reverse Repo Rate are the frequently used tools with which the RBI can control the availability and the supply of money in the economy.

- RR is always greater than RRR in India

| Repo Rate: (RR) | Reverse Repo Rate: (RRR) |

|

|

Reserve Bank of India and Rural Credit

- In a developing economy like India, the Central bank of the country cannot confine itself to the monetary regulation only, and it is expected that it should take part in development function in all sectors especially in the agriculture and industry.

Role of RBI in agricultural credit

- RBI has been playing a very vital role in the provision of agricultural finance in the country.

- The Bank’s responsibility in this field had been increased due to the predominance of agriculture in the Indian economy and the inadequacy of the formal agencies to cater to the huge requirements of the sector.

- In order to fulfill this important role effectively, the RBI set up a separate Agriculture Credit Department.

- However, the volume of informal loans has not declined sufficiently.

Functions of Agriculture Credit Department:

- To maintain an expert staff to study all questions on agricultural credit;

- To provide expert advice to Central and State Government, State Co-operative Banks and other banking activities.

- To finance the rural sector through eligible institutions engaged in the business of agricultural credit and to co-ordinate their activities.

- The duties of the RBI in agricultural credit were much restricted as it had to function only in an ex-officio capacity being the Central Bank of the country.

- It could not lend directly to the farmers, but the supply of rural credit was done through the mechanism of refinance with institutions specializing in rural credit.

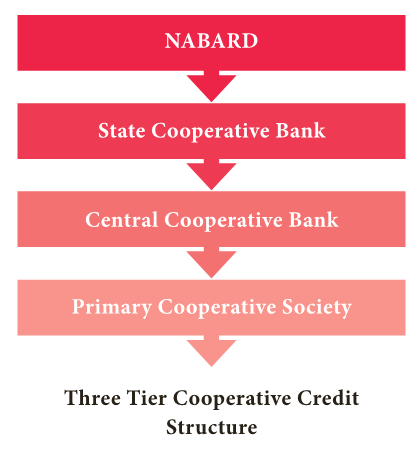

- Primary societies may borrow from Central Co-operative Bank, and the latter may borrow from the apex or the State Co-operative Bank, which in its turn might get accommodation facilities from the RBI.

- The RBI was providing medium- term loans also for a period exceeding 15 months to 5 years for reclamation of land, construction of irrigation works, purchase of machinery, etc.

- The Reserve Bank of India was also providing long-term loans to fiancé permanent changes in land and also for the redemption of old debts.

- With the establishment of National Bank for Agriculture and Rural Development (NABARD), all the functions of the RBI relating to agricultural credit had been taken over and looked after by NABARD since 1982.

- Since then, all activities relating to rural credit are entirely looked after by NABARD.

The Agricultural Refinance Development Corporation (ARDC)

- Farmers in India require mainly medium term and long term loans and they face a lot of difficulties in getting them.

- The only organization providing long term credit is Land Development Banks which have lagged behind and recorded only limited success.

- The credit requirements of the agricultural sector are increasing year after year. With the aim of bridging the gap in agricultural finance and to extend credit for projects involving agricultural development, an organization called the Agricultural Refinance Development Corporation (ARDC) was established by an Act of Parliament and it started functioning from July 1, 1963.

Objectives of the ARDC:

- To provide necessary funds by way of refinance to eligible institutions such as the Central Land Development Banks, State Co-operative Banks, and Scheduled banks.

- To subscribe to the debentures floated by the Central Land Development banks, State Co-operative Banks, and Scheduled banks, provided they were approved by the RBI.

Regional Rural Banks (RRBs)

- One of the important points of the 20 points economic programme of Mrs. Indira Gandhi during emergency was the liquidation of rural indebtedness by stages and provide institutional credit to farmers and artisans in rural areas.

- It was in pursuance of this aspect of the New Economic programme that the Government of India setup Regional Rural Banks (RRBs) on 1975.

- The share capital of RRB is subscribed by the Central Government (50%), the State Government concerned (15%), and the sponsoring commercial bank (35%).

- The main objective of the RRBs is to provide credit and other facilities particularly to the small and marginal farmers, agricultural labourers, artisans and small entrepreneurs so as to develop agriculture, trade, commerce, industry and other productive activities in the rural areas.

Concessions to RRBs

- From the beginning, the sponsor banks have continued to provide managerial and financial assistance to RRBs and also other concessions such as lower rate of interest (8.5 per cent) on the latter’s borrowings from sponsor banks.

- Further, the cost of staff deputed to RRBs and training expenses of RRB staff are borne by the sponsor banks.

The RBI has been granting many concessions to RRBs:

- They are allowed to maintain cash reserve ratio at 3 per cent and statutory liquidity ratio at 25 per cent; and

- They also provide refinance facilities through NABARD.

NABARD and its role in Agricultural credit

- Since its inception, RBI has shown keen interest in agricultural credit and maintained a separate department for this purpose.

- RBI extended short-term seasonal credit as well as medium-term and long-term credit to agriculture through State level co-operative banks and Land Development banks.

- At the same time, RBI has also set up the Agricultural Refinance Development Corporation (ARDC) to provide refinance support to the banks to promote programmes of agricultural development, particularly those requiring term credit. With the widening of the role of bank credit from “agricultural development” to “rural development” the Government proposed to have a more broad-based organization at the apex level to extend support and give guidance to credit institutions in matters relating to the formulation and implementation of rural development programmes.

- A National Bank for Agriculture and Rural Development (NABARD), was therefore, set up in July 1982 by an Act of parliament to take over the functions of ARDC and the refinancing functions of RBI in relation to co-operative banks and RRBs.

- NABARD is linked organically with the RBI by the latter contributing half of its share capital the other half being contributed by the Government of India (GOI).

- GOI nominates three of its Central Board Directors on the board of NABARD.

- A Deputy Governor of RBI is appointed as Chairman of NABARD.

Functions of NABARD

- NABARD has inherited its apex role from RBI i.e, it is performing all the functions performed by RBI with regard to agricultural credit.

- NABARD acts as a refinancing institution for all kinds of production and investment credit to agriculture, small-scale industries, cottage and village industries, handicrafts and rural crafts and real artisans and other allied economic activities with a view to promoting integrated rural development.

- It provides short-term, medium- term and long-term credits to state co-operative Banks (SCBs), RRBs, LDBs and other financial institutions approved by RBI.

- NABARD gives long-term loans (upto 20 Years) to State Government to enable them to subscribe to the share capital of co-operative credit societies.

- NABARD gives long-term loans to any institution approved by the Central Government or contribute to the share capital or invests in securities of any institution concerned with agriculture and rural development.

- NABARD has the responsibility of co-ordinating the activities of Central and State Governments, the Planning Commission (now NITI Aayog) and other all India and State level institutions entrusted with the development of small scale industries, village and cottage industries, rural crafts, industries in the tiny and decentralized sectors, etc.

- It has the responsibility to inspect RRBs and co-operative banks, other than primary co-operative societies.

- It maintains a Research and Development Fund to promote research in agriculture and rural development

Reserve bank of India and industrial finance

- Though industries get finance from commercial banks, the quantum and the term will be very much limited generally.

- Commercial banks lend for short term only, as they get only short-term deposits from the public.

- Further lending to industries is only a fragment of the total lending by the banks.

- Hence, there is a need and urgency of establishing long-term credit facilities to industries.

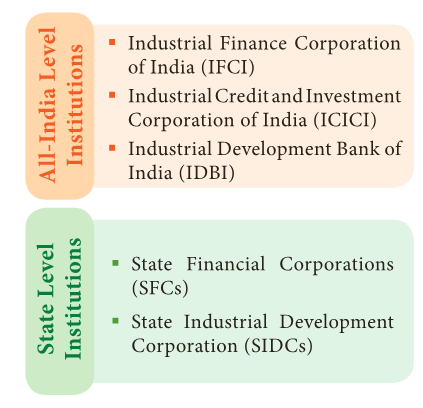

- The institutional set-up in India for financing and promoting industries are as follows

Institutional Set-up:

All-India Level Institutions

- Industrial Finance Corporation of India (IFCI)

- Industrial Credit and Investment Corporation of India (ICICI)

- Industrial Development Bank of India (IDBI)

State Level Institutions

- State Financial Corporations (SFCs)

- State Industrial Development Corporation (SIDCs)

All-India Level Institutions:

1. Industrial Finance Corporation of India (IFCI)

- This was first in the chain of establishment of financial corporations to provide financial assistance for industrial development.

- This was established on July 1, 1948 under the Act of the Parliament.

- IFCI provides assistance to the industrial concerns in the following ways:

- Long-term loans; both in rupees and foreign currencies.

- Underwriting of equity, preference and debenture issues.

- Subscribing to equity, preference and debenture issues.

- Guaranteeing the deferred payments in respect of machinery imported from abroad or purchased in India; and

- Guaranteeing of loans raised in foreign currency from foreign financial institutions.

- Financial assistance of IFCI can be availed by any Limited Company in the public, private or joint sector, or by a co- operative society incorporated in India, which is engaged or proposes to be engaged in the specified industrial activities.

- Such financial assistance will be available for the setting up of new industrial projects and also for the expansion diversification, renovation or modernisation of existing ones.

- The IFCI also provides financial assistance on concessional terms for setting up industrial projects in industrially less developed districts in the States or Union Territories notified by the Central Government, The IFCI raises its resources by way of

- issue of bonds in the market;

- borrowing from Industrial Development Bank of India and the Central Government;

- foreign credit secured from foreign financial institutions and borrowings in the international capital markets.

3. Industrial Credit and Investment Corporation of India (ICICI)

Functions of ICICI

- Assistance to industries

- Provision of foreign currency loans

- Merchant banking

- Letter of credit

- Project promotion

- Housing loans

- Leasing operations

- This was set up on 5th January 1955 as a joint-stock company on the advice given by a three-man mission sponsored by the World Bank and The Government of USA to the Government of India.

- The principal purpose of this institution is to channelize the World Bank funds to industry in India and also to help build up a capital market.

- Initially the capital of ICICI was held by private companies, institutions and individuals.

- But now, a very large part of its equity capital is held by public sector institutions, such as banks, LIC, GIC and its subsidiaries, as ‘this private institution was nationalized.

- The significant feature of the operations of ICICI is the foreign currency loans sanctioned by this institution to industries.

- Since its inception, nearly 50 per cent of its disbursement had been in foreign currencies.

- This is possible because of the facility it enjoys of raising funds in foreign currencies.

- The World Bank has been the single largest source of such funds.

- Since 1973, the ICICI has entered the international capital markets also for raising foreign currency loans.

- The major portion of its rupee resources is raised by way of debentures in the capital market.

- The ICICI also borrows from the Industrial Development Bank of India and the Government.

- The major portion of its assistance has gone to the private sector.

3. Industrial Development Bank of India (IDBI)

- The Industrial Development Bank of India has been conceived with the primary object of creating an apex institution to co-ordinate the activities of other financial institutions, including banks.

- The Development Bank was a wholly owned subsidiary of the Reserve Bank of India upto February 15, 1976.

- It was delinked from the RBI with effect from February 16, 1976 and made an autonomous corporation fully owned by the Government of India.

Functions of IDBI:

- The functions of IDBI fall into two groups

- Assistance to other financial institutions; and

- Direct assistance to industrial concerns either on its own or in participation with other institutions.

- The IDBI can provide refinance in respect of term loans to industrial concerns given by the IFC, the SFCs, other financial institutions notified by the Government, scheduled banks and state cooperative banks.

- A special feature of the IDBI is the provision for the creation of a special fund known as the Development Assistance Fund.

- The fund is intended to provide assistance to industries which require heavy investments with low anticipated rate of return.

- Such industries may not be able to get assistance in the normal course.

- The financing of exports was also undertaken by the IDBI till the establishment of EXIM BANK in March, 1982.

State Level Institutions

1. State Financial Corporation (SFCs)

- The government of India passed in 1951 the State Financial Corporations Act and SFCs were set up in many states.

- The SFCs are mainly intended for the development of small and medium industrial units within their respective states. However, in some cases they extend to neighboring states as well.

- The SFCs provide loans and underwriting assistance to industrial units having paid-up capital and reserves not exceeding Rs 1 crore.

- The maximum amount that can be sanctioned to an industrial concern by SFC is Rs 60 lakhs.

- SFCs depend upon the IDBI for refinance in respect of the term loans granted by them.

- Apart from these, the SFCs can also make temporary borrowings from the RBI and borrowings from IDBI and by the sale of bonds.

2. State Industrial Development Corporations (SIDCOs)

- The Industrial Development Corporations have been set up by the state governments and they are wholly owned by them.

- These institutions are not merely financing agencies; they are entrusted with the responsibility of accelerating the industrialization of their states.

- SIDCOs provide financial assistance to industrial concerns by way of loans guarantees and underwriting of or direct subscriptions to shares and debentures.

- In addition to these, they undertake various promotional activities, such as conducting techno-economic surveys, project identification, preparation of feasibility studies and selection and training of entrepreneurs.

- They also promote joint sector projects in association with private promoter in such type of projects.

- SIDCOs take 26 percent, private co-promoter takes 25 percent of the equity, and the rest is offered to the investing public.

- SIDCOs undertake the development of industrial areas by providing all infrastructural facilities and initiation of new growth centre.

- They also administer various State government incentive schemes.

- SIDCOs get refinance facilities form IDBI.

- They also borrow through bonds and accept deposits.

Monetary Policy

- Monetary Policy is the macroeconomic policy being laid down by the Central Bank towards the management of money supply and interest rate.

- It is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

- The monetary policy gained its significance after the World War II, thanks to the initiation made by Milton Friedman, who is associated with the doctrine of “monetarism” and who received Nobel Prize in 1976.

- He boldly announced in his book “Monetary History of the UnitedStates, 1867 – 1960” that the Great Depression of the 1930’s was largely the outcome of the bungling monetary policies of the Federal Reserve System.

Monetary Policy: Expansionary Vs. Contractionary

- Expansionary policy is cheap money policy when a monetary authority uses its tools to stimulate the economy.

- An expansionary policy maintains short- term interest rates at a lower than usual rate or increases the total supply of money in the economy more rapidly than usual.

- It is traditionally used to try to combat unemployment by lowering interest rates in the hope that less expensive credit will entice businesses into expanding.

- This increases aggregate demand (the overall demand for all goods and services in an economy), which boosts short-term growth as measured by gross domestic product (GDP) growth.

- The Contractionary monetary policy is dear money policy, which maintains short-term interest rates higher than usual or which slows the rate of growth in the money supply or even shrinks it.

- This slows short-term economic growth and lessens inflation.

- Contractionary monetary policy can lead to increased unemployment and depressed borrowing and spending by consumers and businesses, which can eventually result in an economic recession if implemented too vigorously.

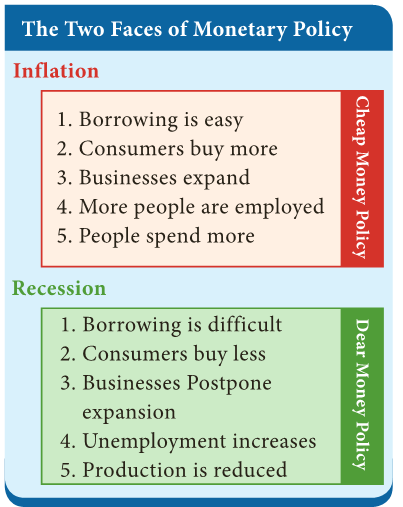

The Two Faces of Monetary Policy

Inflation (Cheap Money Policy)

- Borrowing is easy

- Consumers buy more

- Businesses expand

- More people are employed

- People spend more

Recession (Dear Money Policy)

- Borrowing is difficult

- Consumers buy less

- Businesses Postpone expansion

- Unemployment increases

- Production is reduced

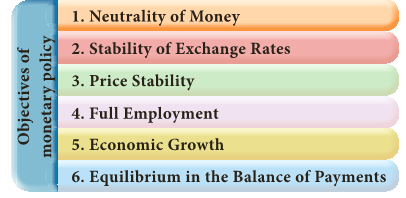

Objectives of Monetary Policy

- The monetary policy in developed economies has to serve the function of stabilization and maintaining proper equilibrium in the economic system.

- But in case of underdeveloped countries, the monetary policy has to be more dynamic so as to meet the requirements of an expanding economy by creating suitable conditions for economic progress.

- It is now widely recognized that monetary policy can be a powerful tool of economic transformation.

The specific objectives of monetary policy are

Objectives of monetary policy

- Neutrality of Money

- Stability of Exchange Rates

- Price Stability

- Full Employment

- Economic Growth

- Equilibrium in the Balance of Payments

1. Neutrality of Money

- Economists like Wicksteed, Hayek and Robertson are the chief exponents of neutral money.

- They hold the view that monetary authority should aim at neutrality of money in the economy.

- Monetary changes could be the root cause of all economic fluctuations.

- According to neutralists, the monetary change causes distortion and disturbances in the proper operation of the economic system of the country.

2. Exchange Rate Stability

- Exchange rate stability was the traditional objective of monetary authority.

- This was the main objective under Gold Standard among different countries.

- When there was disequilibrium in the balance of payments of the country, it was automatically corrected by movements.

- It was popularly known as “Expand Currency and Credit when gold is coming in; contract currency and credit when gold is going out.”

- This system will correct the disequilibrium in the balance of payments and exchange rate stability will be maintained.

- It must be noted that if there is instability in the exchange rates, it would result in outflow or inflow of gold resulting in unfavorable balance of payments.

- Therefore, stable exchange rates are advocated.

3. Price Stability

- Economists like Crustave Cassel and Keynes suggested price stabilization as a main objective of monetary policy.

- Price stability is considered the most genuine objective of monetary policy.

- Stable prices repose public confidence.

- It promotes business activity and ensures equitable distribution of income and wealth.

- As a consequence, there is general wave of prosperity and welfare in the community.

- But it is admitted that price stability does not mean ‘price rigidity’ or ‘price stagnation’.

- A mild increase in the price level provides a tonic for economic growth. It keeps all virtues of a stable price.

4. Full Employment

- During world depression, the problem of unemployment had increased rapidly.

- It was regarded as socially dangerous, economically wasteful and morally deplorable.

- Thus, full employment was considered as the main goal of monetary policy.

- With the publication of Keynes’ General Theory of Employment, Interest and Money in 1936, the objective of full employment gained full support as the chief objective of monetary policy.

5. Economic Growth

- Economic growth is the process whereby the real per capita income of a country increases over a long period of time.

- It implies an increase in the total physical or real output, production of goods for the satisfaction of human wants.

- Therefore, monetary policy should promote sustained and continuous economic growth by maintaining equilibrium between the total demand for money and total production capacity and further creating favourable conditions for saving and investment.

- For bringing equality between demand and supply, flexible monetary policy is the best course.

6. Equilibrium in the Balance of Payments

- Equilibrium in the balance of payments is another objective of monetary policy which emerged significant in the post war years.

- This is simply due to the problem of international liquidity on account of the growth of world trade at a more faster speed than the world liquidity.

- It was felt that increasing of deficit in the balance of payments reduces the ability of an economy to achieve other objectives.

- As a result, many less developed countries have to curtail their imports which adversely affects development activities.

- Therefore, monetary authority makes efforts to maintain equilibrium in the balance of payments.

Recent Advancements in Banking Sector

E- Banking

- Online banking, also known as internet banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

- The online banking system typically connects to or be part of the core banking system operated by a bank and is in contrast to branch banking which was the traditional way customers accessed banking services.

- Today, “virtual banks” (or “direct banks”) have only an internet presence, which enables them to lower costs than traditional brick-and-mortar banks.

RTGS and NEFT

- Inter Bank Transfer enables electronic transfer of funds from the account of the remitter in one Bank to the account of the beneficiary maintained with any other Bank branch.

- There are two systems of Inter Bank Transfer – RTGS and NEFT.

- Both these systems are maintained by RBI. NEFT operates in half hourly batches.

- Currently there are twenty three settlements from 8 am to 7 pm on all working days including working Saturdays.

- Therefore, the beneficiary can expect to get the credit for the transactions put through between 8 am to 5.30 pm on all working days including working Saturdays on the same day.

- For transactions settled in the 6.30 and 7 pm batches on all working days including working Saturdays, the credit will be afforded either on the same day or on the next working day.

| NEFT | RTGS |

|

|

|

|

|

|

|

|

ATM (Automated Teller Machine)

- ATMs transformed the bank tech system when they were first introduced in 1967.

- The next revolution in ATMs is likely to involve contactless payments.

- Much like Apple Pay or Google Wallet, soon we will be able to conduct contactless ATM transactions using a smart phone.

- Some ATM innovations are already available overseas.

- For example, biometric authentication is already used in India, and its recognition is in place at Qatar National Bank ATMs.

- These technologies can help overall bank security by protecting against ATM hacks.

Paytm

Payments Bank.

- In August 2015, Paytm received a license from RBI to launch a payments bank.

- The Paytm Payments Bank is a separate entity in which founder Vijay Shekhar Sharma will hold 51% share, One97 Communications holds 39% and 10% will be held by a subsidiary of One97 and Sharma.

Debit card and Credit Card

- A Debit card is a card allowing the holder to transfer money electronically from their bank account when making a purchase.

- A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder’s promise to the card issuer to pay them for the amounts so paid plus the other agreed charges.

- The card issuer (usually a bank) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

- In other words, credit cards combine payment services with extensions of credit.

- Complex fee structures in the credit card industry may limit customers’ ability to shopping.

Recent Issues

- Once the borrower fails to make interest or principal payments for 90 days the loan is considered to be a non- performing asset (NPA).

- NPAs are problematic for financial institutions since they depend on interest payments for income.

- As on now the size of NPAs is estimated to be around 10 lakh crores.

- As a result, the banks do not have adequate capital.

- Hence the Government (of India) is forced to infuse capital to the banks by using poor tax – payers money.

- Already more than a sum of Rs 2 lakh crores have been injected.

- During 2018 – 19, the GOI has infused Rs68,000 crores into the banking system.

- Thus the NPAs ultimately affect the common people.

Merger of Banks

- Union Cabinet decided to merge all the remaining five associate banks of State Bank Group with State Bank of India in 2017.

- After the Parliament passed the merger Bill, the subsidiary banks have ceased to exist.

- Five associates and the Bharatiya Mahila Bank have become the part of State Bank of India (SBI) beginning April 1, 2017.

- This has placed State Bank of India among the top 50 banks in the world. The five associate banks that were merged are State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP) and State Bank of Travancore (SBT).

- The other two Associate Banks namely State Bank of Indore and State Bank of Saurashtra had already been merged with State Bank of India.

- After the merger, the total customer base of SBI increased to 37 crore with a branch network of around 24,000 and around 60,000 ATMs across the country.

Money Market

- Money market is the mechanism through which short term funds are loaned and borrowed.

- It designates financial institutions which handle the purchase, sale and transfer of short term credit instruments.

- Commercial banks, acceptance houses, Non Banking Financial Institutions and the Central Bank are the institutions catering to the requirements of short term funds in the money Market.

Capital Market

- Capital Market is a part of financial system which is concerned with raising capital by dealing in shares, bonds and other long term investments.

- The market where investment instruments like bonds, equities and mortgages are traded is known as the capital market

Demonetisation

- Demonetisation is the act of stripping a currency unit of its status as legal tender.

- It occurs whenever there is a change of national currency.

- The current form or forms of money is pulled from circulation, often to bereplaced with new coins or notes.

- On 8 November 2016, the Indian Prime Minister Mr. Narendra Modi announced the demonetization of all Rs500 and Rs1000 bank notes of the Mahatma Gandhi Series.

- However, more than 99% of those currencies came back to the RBI.

Objectives of Demonetisation

- Removing Black Money from the country.

- Stopping of Corruption.

- Stopping Terror Funds.

- Curbing Fake Notes

Summary

- It is well-recognized that the financial sector plays a critical role in the development process of a country.

- Financial institutions, instruments and markets that constitute the financial sector act as a conduit for the transfer of resources from net savers to net borrowers, that is, from those who spend less than they earn to those who spend more than they earn.

- The outcome of the various reform measures so far has been impressive and banks have responded to the deregulation and the increasingly competitive environment by restructuring their operation and upgrading performance standards.

- However, in the 2010s the volumes of NPAs have increased sharply.

MORE TO KNOW:

Primary Deposits

- It is out of these primary deposits that the bank makes loans and advances to its customers.

- The initiative is taken by the customers themselves. In this case, the role of the bank is passive.

- So these deposits are also called “Passive deposits”.